Posts

- Revised Productivity and Says to possess Reimburse | Royal Panda casino

- CPP Commission Plan and you may Work with Reputation to possess 2025: Secret Dates, Increases, and the ways to Maximize your Payouts

- Leap contains the high analysis from your citizens on the internet!

- Greatest cuatro Reasons why you should Choose $5 Put Casinos

- $5 Deposit Casino Bonus Australia

By hanging out right here having Roost, your agree to our very own Terms of service, Courtroom Disclaimer, and Advertisements Revelation. It is told one to tenants publish request emails from the official post (return bill questioned) otherwise that have some other provider that give a bill, installing the new beginning day. Along with an interest in greater transparency along the way regarding the go out they disperse it to the months after they get-out, residents shared choice concerning the fee alone. Energetic resident shelter put administration initiate to your disperse-inside the date. Delivering photographs of the status of your flat – regarding the walls to the floors to your appliances – is essential. Security deposit requirements can be as reduced while the $three hundred so that as high since the $3,100000.

Revised Productivity and Says to possess Reimburse | Royal Panda casino

In case your estate otherwise trust generated only one payment, go into the serial matter your FTB stamped for the deal with of your terminated find out if available, to your dotted range to the left of your own amount to the range 29. It appendix contains the comments nonresident alien instructors and you can scientists need to document that have Function 8233 in order to allege an income tax pact exception from withholding away from income tax on the payment to have founded individual functions. To own treaty regions maybe not noted, attach a statement within the a design exactly like the individuals for other treaties.

The guidelines considering here to choose while you are an excellent U.S. resident don’t override income tax pact definitions out of residence. While you are a dual-resident taxpayer, you could nevertheless allege the huge benefits lower than an income tax treaty. A twin-resident taxpayer is one that is a citizen from the You and something nation below per nation’s taxation legislation. The funds tax pact between the two places need to have a good supply that give to own resolution away from conflicting states from residence (tiebreaker code). When you are treated as the a citizen out of a different country below a tax pact, you’re handled because the a nonresident alien inside figuring the You.S. tax.

CPP Commission Plan and you may Work with Reputation to possess 2025: Secret Dates, Increases, and the ways to Maximize your Payouts

Organizations such as Jetty, Royal Panda casino HelloRented, or LeaseLock provide such as things for functions. The new lease tend to explain charges which can be non-refundable as well as deductions they’ll generate is always to damage can be found. Perhaps you have realized, it’s a little detailed and you may talks about a few things that you should end up being mindful from the when you reside in the new apartment and in case your move out.

Leap contains the high analysis from your citizens on the internet!

The principles to have withholding and you will using more than it count is comparable on the laws and regulations to have conversion out of You.S. real property hobbies. You will discover a form 8288-A good highlighting extent withheld that you might next allege to your line 25f of your Mode 1040-NR while the a card contrary to the taxation you borrowed to the acquire. You happen to be in a position to render specific advice to the transferee to reduce or lose withholding. If you are a transferee one to did not keep back, under section 1446(f)(4), the relationship must withhold on the distributions to you personally an enthusiastic matter comparable to the fresh income tax you did not keep back (along with interest, in the event the relevant).

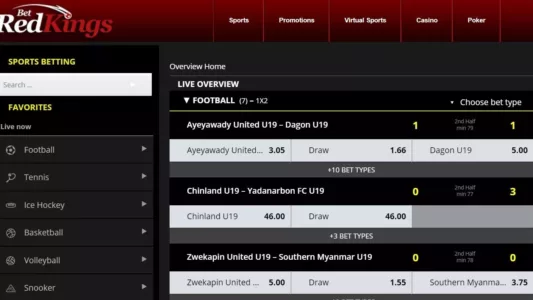

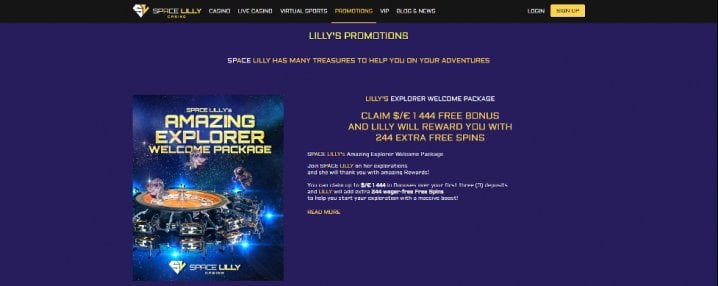

Greatest cuatro Reasons why you should Choose $5 Put Casinos

- Of a lot will ask you for a low-refundable clean up percentage which discusses things such as washing the carpets.

- In this post i determine everything you to know regarding the Canada’s greatest $5 minimum deposit casinos.

- This won’t apply if you possibly could let you know from the obvious and you can persuading evidence which you got practical actions being conscious of the brand new processing criteria and high procedures so you can conform to the individuals standards.

- If you don’t have an income tax house regarding the Joined States, the new acquire otherwise losings may be considered of offer away from All of us.

- Anyone paid to arrange tax returns for other people need to have an excellent thorough understanding of income tax matters.

- To possess a listing of most recent global societal defense arrangements, see SSA.gov/international/position.html.

Claim the newest tax withheld since the an installment on the web 25f away from Setting 1040-NR. Your employer is responsible for withholding the brand new 0.9% (0.009) A lot more Medicare Taxation on the Medicare wages or Railway Senior years Income tax Operate (RRTA) settlement it pays to you personally more than $2 hundred,one hundred thousand inside 2024. If you don’t owe More Medicare Income tax, you could claim a credit for withheld More Medicare Tax contrary to the total tax responsibility revealed on the taxation go back from the processing Form 8959. You can’t bring any credit to own fees imposed by the a different country otherwise U.S. region in your You.S. source earnings when the those taxes had been implemented only because you are a resident or citizen of the overseas country otherwise territory. An excellent cuatro% taxation price relates to transportation money that’s not effectively connected as it does not meet with the a couple of requirements detailed before lower than Transport Earnings.

In some cases, the main points and you may points will call to own an apportionment for the a great day base, because the said next. As well as look at the container and you will go into its term for individuals who and you may their nonresident mate produced the decision to become addressed because the citizens within the a prior seasons plus the alternatives stays essentially. Lola stumbled on the us the very first time to the March step 1, 2024, and you can existed here until August 25, 2024. To the December twelve, 2024, Lola stumbled on the usa for travel and you can returned to Malta to your December 16, 2024. Lola could possibly expose a closer connection to Malta to have the remainder of 2024 birth August twenty-five, 2024, when she departs the united states. Lola are a citizen within the generous visibility sample because the Lola is actually contained in the usa to own 183 months (178 weeks to your several months February step one to help you August twenty-five as well as 5 days in the December).

And the renters simply couldn’t conserve the money,” Mizushima says. Sophie Household, judge other during the NYU Furman Cardiovascular system, says highest deposits can make it harder for people to leave homelessness otherwise unsafe way of life things, for example a property with an enthusiastic abusive companion. Even if it abrasion along with her the bucks to go, remaining thousands of dollars tied within the a security put are an encumbrance to own lower-money renters, and can avoid them away from fulfilling the costs, medical expenses, or other needs. Inside the 2020, the new all over the country mediocre lease to own a single-rooms flat is $step 1,621. You to definitely profile, and the undeniable fact that 40 percent away from Americans can be’t pay for surprise $400 expenses, allows you observe why higher shelter dumps will be a major challenge for low-earnings clients. Escrow accounts for shelter dumps give security and you can comfort for both landlords and you may tenants.

$5 Deposit Casino Bonus Australia

A protection deposit is the safety net whenever indeed there’s wreck or delinquent lease. To protect yourself, usually gather maximum deposit welcome, certainly county its words from the book, realize your state’s deposit laws and regulations, and you may punctually come back any vacant part if your occupant motions out. Because the a property owner otherwise landlord, you shouldn’t invest in which. A safety put is supposed to possess will cost you incurred following renter departs, including outstanding book or damage fixes.

Company of Houses and you may Urban Development’s (HUD) Lease Reasonableness Assistance, ERAP may provide to 5 times the fresh leasing amount founded for the area area code and you may rooms size of the fresh apartment/household. Add their You.S. notes to the PayPal‡Legal Disclaimer (reveals in the popup),39Legal Disclaimer (opens up inside popup) account to transmit money in order to relatives and buddies regarding the You.S. Find out how much you’ll save once you spend no international purchase charge to the You.S. deals. Determine the present day Canadian so you can You.S. dollar foreign exchange rate.